Public Affairs Online: The Race To A $1Trillion Economy: How Policy, Markets and Reputation Will Decide Nigeria’s Economic Destiny

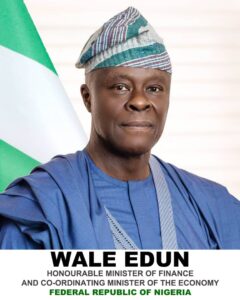

When President Bola Ahmed Tinubu announced his ambition for Nigeria to become a $1 trillion economy, it sparked conversations across policy circles, financial markets, and development spaces. For some, it sounded aspirational; for others, it reflected a timely shift toward scale, competitiveness, and long-term planning. What is now clear is that global institutions are beginning to reassess Nigeria’s economic direction, not based on rhetoric, but on tangible signals coming from reforms and early market responses.

On November 14, S&P Global Ratings revised Nigeria’s outlook from Stable to Positive while affirming its B-/B sovereign rating. This followed Moody’s upgrade to B3 in May, and Fitch’s decision to maintain a stable outlook. For a country that has struggled in recent years to earn the confidence of global markets, these are early but meaningful signs. They signal that Nigeria is returning to the radar of major rating agencies and long-term investors – however cautiously.

The question is not whether the ambition is possible. It is whether Nigeria can sustain the discipline, consistency, and credibility needed to support a trillion-dollar economic expansion. The answer depends on policy design, sector productivity, global conditions, and how Nigeria manages its reputation in an increasingly complex world.

- Reform Momentum: A New Foundation, but Still Fragile

Nigeria’s current economic reset is anchored on several bold reforms:

- Petrol subsidy removal, freeing up fiscal resources previously costing nearly $10 billion annually.

- Exchange rate unification, addressing distortions and bringing transparency to the FX market.

- Tighter monetary policy, aimed at stabilizing inflation and signaling renewed central bank independence.

- Efforts to strengthen fiscal discipline, including steps to reduce leakages and clarify reporting.

These reforms have helped shift international perception, but they remain extremely sensitive to implementation. Global markets watch Nigeria closely, and any sign of reversal, or even uncertainty, can weaken confidence.

For Nigeria to maintain credibility, three factors will matter:

- Depth and consistency of reforms, not episodic adjustments.

- Protection of vulnerable households as inflation settles.

- Clear and unified policy communication, especially around FX, tariffs, and subsidy management.

The trillion-dollar ambition is not built on announcements; it is built on long-term credibility.

- Fiscal Strategy: Nigeria Must Finance the Growth It Envisions

A trillion-dollar economy requires significant investment in power, infrastructure, industrialization, and human capital. Nigeria’s current fiscal space is limited, and revenue remains a critical weakness.

Key developments include:

- Suspension of the proposed 15% ad-valorem duty on imported petroleum products, with government statements confirming that implementation is not currently in view. Some technical discussions suggest reconsideration in 2026, but for now, the suspension is clear.

- Ongoing efforts to harmonize the country’s tax administration system, reducing duplication across agencies.

- Sustained improvements in FIRS automation and digitization, strengthening revenue visibility.

- Growth in non-oil revenue, though still small relative to potential.

Despite these improvements, Nigeria’s tax-to-GDP ratio remains around 10%, among the lowest globally. For comparison:

- African average: ~16%

- OECD average: ~34%

- Emerging markets (e.g., Brazil, South Africa): 20–28%

Nigeria cannot rely on borrowing alone. To fund economic expansion:

- The tax net must widen.

- Compliance must improve through technology.

- Revenue policy must avoid overburdening MSMEs or discouraging investment.

- Fiscal coordination must improve across ministries and agencies.

- Wastages and corrupt practices must be reduced drastically if they cannot be eliminated.

This is not about raising taxes; it is about modernizing how Nigeria earns.

- Market Signals: Borrowing Strategy and Investor Sentiment

Nigeria’s return to the international bond market this year sent an important signal. The country successfully raised $2.35 billion in Eurobonds, with reported investor demand exceeding $13 billion, a level of interest Nigeria had not seen in years.

This oversubscription does not imply that Nigeria’s macro challenges are resolved. Rather, it reflects that:

- Global investors are once again paying attention.

- Nigeria’s reform signals are generating cautious confidence.

- Market participants see potential if reforms continue.

Going forward, investors will focus on:

- Inflation trends and whether the tightening cycle delivers stability.

- FX market transparency and the pace of liquidity improvements.

- Fiscal discipline, especially around subsidies and tax reform.

- Security conditions, particularly in agricultural and industrial belts.

Stable policy and clear communication are essential to sustaining confidence.

- Global Environment: How External Shocks Shape Nigeria’s Outlook

Nigeria’s trillion-dollar ambition will unfold in a global environment marked by volatility. The U.S. administration’s “Liberation Day” tariffs introduced broad-based import duties, triggering significant global market reactions.

Recent global developments relevant to Nigeria include:

- Oil prices slipping to around $64 per barrel, below Nigeria’s fiscal assumptions.

- Trillions wiped off global equity markets in the days following the tariff announcements.

- Naira volatility, driven partly by global risk aversion across emerging markets.

- Portfolio outflows, as investors reposition to safer assets.

Nigeria also faces a 14% tariff under the U.S. tariff regime, affecting certain export categories and shaping market psychology around crude oil.

External shocks are not new, but their scale and frequency underscore an important reality:

Nigeria’s economic future is increasingly connected to global trends.

Policy decisions must therefore be grounded in risk analysis, diversification, and resilience planning.

- Sectoral Drivers: What Will Actually Power a $1 Trillion Economy?

No single sector can carry Nigeria to a trillion-dollar economy. The transformation requires productivity across multiple engines.

- Power Sector: The Gatekeeper of Growth

Nigeria loses an estimated $29 billion annually due to unreliable electricity.

Achieving industrial scale requires:

- improved transmission and distribution

- cost-reflective tariffs with targeted protections

- stronger regulatory enforcement

- investments in generation and metering

Power reliability is the foundation of competitiveness.

2. Agriculture and Agro-Industrialization

With 84 million hectares of arable land, agriculture has capacity to drive GDP growth and exports.

But three constraints persist:

- insecurity

- post-harvest losses

- limited processing capacity

Scaling agro-industrial zones could unlock jobs and foreign exchange.

3. Technology and Digital Economy

Nigeria remains one of Africa’s leading tech ecosystems.

With the right enabling environment, including broadband expansion, digital identity infrastructure, and strong IP protections, ICT could become a top contributor to GDP.

4. Manufacturing and Industry

Manufacturing cannot expand under unpredictable trade policy or high logistics costs.

Nigeria must invest in:

- port modernization and democritisation

- efficient customs operations

- stable energy supply

- special economic zones

- local supply chain development

5. Creative Economy and Tourism

Lagos’ entertainment industry continues to gain global visibility.

With improved infrastructure, destination marketing, and visa reform, this sector can grow into a major foreign exchange earner.

- Security: The Most Binding Constraint on Nationwide Productivity

Security challenges remain a major obstacle to investment.

The effects are visible:

- farmers displaced from productive land

- oil theft reducing output and revenue

- rising transport and logistics costs

- investors delaying or canceling expansion plans

Without safety and stability, growth projections are weakened.

Economic and security strategies must align, protecting industrial corridors, agricultural belts, and national infrastructure.

- Reputation Diplomacy: Nigeria’s Global Image as an Economic Asset

In today’s interconnected markets, perception is power.

A country’s reputation shapes:

- investor confidence

- cost of borrowing

- FDI flows

- trade negotiations

- development partnerships

- geopolitical leverage

Nigeria’s global image has fluctuated in recent years, and recent commentary from international actors shows how easily perceptions can shift.

Reputation must be managed deliberately, through coordinated communication, strong regulatory credibility, and consistent signals from government institutions.

A trillion-dollar economy requires a trillion-dollar reputation framework.

- Policy Priorities: What Nigeria Must Do Next

To move from ambition to action, Nigeria must:

- Strengthen macroeconomic reforms through consistent policies and transparent coordination.

- Mobilize revenue efficiently, focusing on digital compliance and a broader tax net.

- Stabilize power and infrastructure, unlocking industrial competitiveness.

- Integrate security and economic strategy, protecting productivity and supply chains.

- Enhance investor confidence through predictable policies and unified communication.

- Invest in human capital, particularly PHC, education, and workforce skills.

- Build and protect Nigeria’s global reputation, aligning diplomacy with economic goals.

Conclusion: A Vision Within Reach – If Nigeria Sustains the Discipline

Nigeria has the scale, talent, natural resources, and entrepreneurial energy to achieve a trillion-dollar economy. The reform signals emerging today are promising, and global markets are beginning to respond.

But this ambition requires more than early momentum.

It demands consistency, policy clarity, institutional strength, and a deliberate effort to align Nigeria’s reputation with its economic aspirations.

This analysis is written and published by the Public Affairs Practice of CMC Connect LLP

- Email: publicaffairs@cmcconnect.com

- Editor in Chief – Yomi Badejo-Okusanya

- Editor – Adetola Odusote

- Writer/Lead Analysts – Henrietta Nsa, Sylvester Ugwuanyi

- Graphics– CMC Connect LLP Creative Team: James Ibukun, Ayomide Omole

This is quite insightful

Well done Team CMC. Let’s have more of this concise analysis. Cheers.

What a wonderful analysis. Entrepreneurs and business leaders should read to find opportunities in the current government.